People choose mobile phones for money transfers more than they used to. According to the research , around 69% of smartphone users prefer sending money to individuals through an app rather than a website. Carrying cash is almost a bad manner nowadays, which gives P2P payment apps like Google Pay, PayPal, or Venmo time to shine.Some of the common challenges when building online payment applications are:

Such a demand makes mobile payment app development one of the most popular services in the global tech arena. By 2026, North America's mobile wallet market segment will reach a staggering $80 billion, as the source suggests. Financial startups spring every day, winning the hearts of consumers. Yet, payment apps development is a laborious process associated with fraud risks, security breaches, and scalability issues all of which necessitates cooperation with a competent partner.

Our tech specialists have prepared a step-by-step explanation about how to create a payment app. Keep reading and disanchorcover the mobile payment app development process and the best practices below.

What is a P2P payment app?

Peer-to-peer payment apps (P2P) are mobile applications that allow users to transfer money from one app to another. They are also called mobile payment or money transfer applications. The reason to send money can be anything, from a car ride to an international payment.

Overall, with P2P payment solutions, payers can:

- Complete transactions in multiple currencies and languages across the globe

- Use online and mobile money remittance

- Track their money transfers and view transaction fees

- Request payments from their peers

- Share payments between multiple peers and more

How to build a P2P payment app: approaches and reasons

How does a money transfer app work?

How does a money transfer app work?

Although P2P applications differ in functionality, they all work similarly. To start using a P2P app, the user must create an account and verify their identity. After that, they can link their card(s) or bank account to send and receive payments. Apart from financial details, the app may also prompt the user to share personal information and add multi-factor authentication for additional security.

After the initial settings, it takes several clicks to complete a money transfer. The payer only needs to indicate the amount and the payment details of the recipient. Usually, an email, phone number, or name is enough. Depending on the chosen P2P app, the transfer will take several seconds to several days. Once the money is delivered, the recipient can withdraw it.

Cryptocurrency Betting Platform

We revamped front-and-back-end sides of a cryptocurrency platform

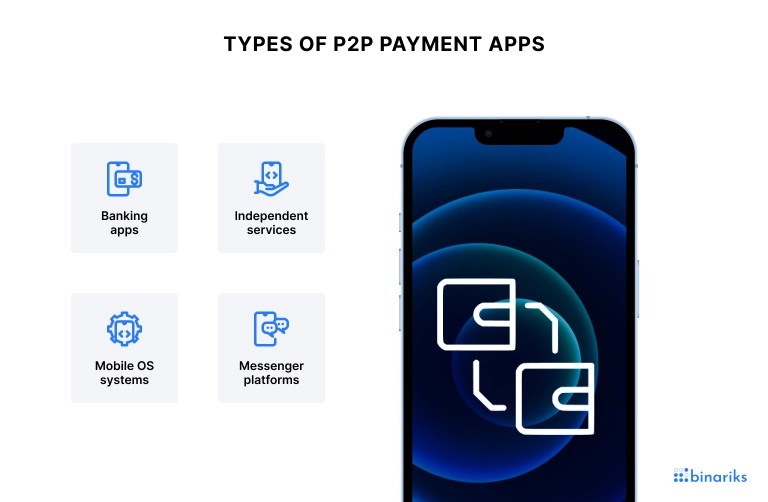

Types of P2P payment apps

Types of P2P payment apps

Mobile payment solutions fall into several broad categories based on who offers them and why. These types include:

- Banking apps. Many banks launch P2P payment applications for their customers to enhance customer service. Frequent mobile banking users show the highest satisfaction with their primary bank – 71% compared to 44% of non-users. P2P banking apps also allow financial organizations to expand into a new market niche.

- Independent services. Independent mobile payment services are created by startups that want to enter the fintech industry. These are solutions like PayPal or Venmo. They provide people with e-wallets to add banking cards for peer-to-peer payments.

- Mobile OS systems. These P2P systems are not truly mobile apps but work very similarly. Solutions like Android Pay and Apple Pay allow users to exchange payments and use NFC technology to pay with their smartphones at stores.

- Messenger platforms. Some social media platforms have also started investing in P2P payment apps development. Now, users can make transfers directly from the messenger for extra convenience. For example, WhatsApp has already launched P2P payments in India and Brazil and currently plans to implement them in the US.

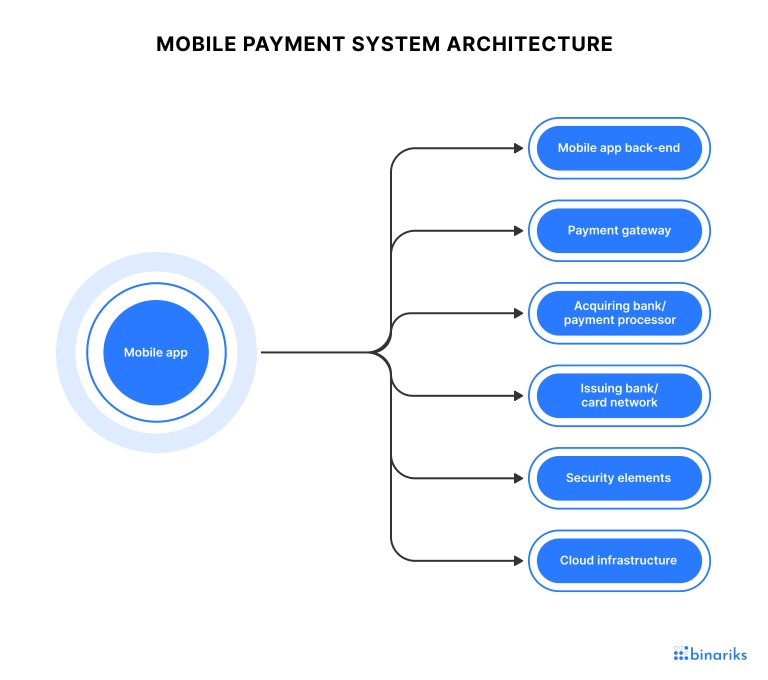

Mobile payment system architecture

A mobile payment app has a complex architecture, with each element tasked to ensure seamless and secure transactions. Major elements of this architecture are:

- Mobile app: An application user interface that customers interact with directly, often with cross-platform development frameworks.

- Mobile app back-end: The mobile app's back-end handles data storage, user authentication, and business logic. It can be created with Node.js, Python, or other languages.

- Payment gateway: A third-party service that processes transactions by transferring payment data between apps, banks, and other parties. It ensures the secure exchange of sensitive information through fraud detection and transaction management.

- Acquiring bank/payment processor: The acquiring bank is responsible for managing the merchant's account, processing transactions, and settling funds. It communicates with the issuing bank to obtain transaction authorization and handles fund transfers.

- Issuing bank/card network: The issuing bank is the financial institution that issues credit or debit cards to customers. It verifies transactions, checks account balance and fraud risk and authorizes or declines transactions.

- Security elements: These elements include encryption (e.g., SSL/TLS), multi-factor authentication, and security standards like PCI DSS that minimize the risks of attacks.

- Cloud infrastructure: Cloud-based infrastructure hosts the mobile payment system components, ensuring scalability and cost efficiency. Examples of cloud providers include Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform.

Top features

Before making the first steps to P2P payment apps development, it's good to understand what functionality you need. With the formulated concept, conveying your ideas to business partners and the tech team will be easier.

Regardless of the type, most money transfer apps have overlapping features. These are must-haves to connect users and enable them to complete money transfers.

Here is the list of essential features to have in a money transfer app:

- Sign in. A sign-in page asks users to enter credentials and may include two-step authentication. For example, the person must provide their email and password and type the code sent to their mobile device afterward. Facial recognition is another popular technology adopted for user identification in financial apps.

- User profile. A profile is where the user shares their personal and contact details. Here they can also pick the language and complete other basic settings.

- Card and bank account linking. This feature allows users to add their card or bank account to the application for future payments. They can also check the card approval status and edit or delete accounts.

- E-wallet. Users can manage their money and complete transactions with the app or mobile device.

- Payment requests. With payment requests, users ask someone to make a transfer. After they enter the required amount and payer's details, the corresponding person will receive the request.

- Reports. They let people see how much they spent and received during the selected period. In P2P apps, reports should have very granular segmentation.

- Currency exchange. Since people often use money transfer solutions for international payments, they need the currency exchange feature. Besides, they may want to keep money in another currency, so you must enable them to switch.

- Notifications. Push notifications inform users about transactions and other significant events in their accounts.

- Real-time support. Chats are the most convenient way to solve customers' issues. In addition to in-app chats, the P2P payment platform should also offer email and phone support.

- Transaction tracking. Transaction tracking provides customers with sufficient information about their account. The best tracking features will have an intuitive design and smart filters to maximize the potential of acquired information.

- POS integration. Point-of-sale integration allows apps to connect with POS systems used by various merchants seamlessly. It allows detailed data to be exchanged between two systems in real time, including QR codes and NFC-based payments.

- Unique OTPs. Using one-time passwords with every single authentication and transaction is an easy way to enhance security of the money transfer app.

You won't do without these features during mobile payment application development. They are crucial for personal funds management and transfers between accounts. It's the foundation of any mobile payment app users expect to have.

Personalization in neobanks

What lessons on personalization in banking should CTOs learn from neobanks?

Pitfalls of building payment app

It is more challenging to create a payment app because of the need to handle sensitive financial data. When it comes to financial security, the stakes of mobile payment application development are high.

Some of the common challenges when building online payment applications are:

- Data security and fraud risks. Online payment application users' personal information and financial data are at risk of fraudulent attacks that are often attempted. People use P2P payment apps to store thousands of dollars, so the risk of unauthorized access is a tipping point for them. To guarantee data security and money safety, the creators of online payment applications should enforce cloud security, and use best practices related to encryption, coding practices, and authentication mechanisms.

- Compliance with regulations. P2P payment apps are subjected to various regulations, including PCI DSS, and money laundering prevention regulations. Failing to comply with relevant financial and data protection regulations can lead to fines and legal issues. To ensure compliance, it is necessary to research the regulations in target markets and consult with legal experts.

- Scalability challenges. P2P payment apps often grow rapidly upon release, so they should be built with scalability in mind. Applications that don't account for growth may suffer from service disruptions and technical issues. Using cloud-based infrastructure and efficient code that can handle the increased load.

- Technological complexity. A P2P app consists of many interlinked technologies, including blockchain technology, encryption, API, e-wallet, and others. It is important not to underestimate the project's complexity and to hire highly-skilled developers to complete the job.

[cont-nav-point id="how-to-build-a-p2p-payment-app" title="How to build a P2P payment app"][/cont-nav-point]How to build a P2P payment app: approaches and reasons

The software development lifecycle for mobile payment app development is similar to other solutions. You will still need to research requirements, create a prototype, do coding, testing, and deployment. As to the approaches, money transfer app development has some favorites. Let's see what best practices companies use, what stages they go through, and why.

Mobile payment app development approaches

In the modern P2P online payment transfer app development field, the Agile approach dominates. Agile combines methods and practices that allow workload redistribution within a team for faster and more efficient development. Business analysts, designers, QA engineers, developers, and other team members work in sprints to deliver the software step by step. Agile adds transparency and allows companies to meet tight deadlines.

Why does it matter in mobile payment apps development? The fintech market is growing and changing extremely fast. Hence, flexibility and speed are essential for success. Besides, Agile development helps optimize expenses and create complex solutions more easily.

Apart from Agile, many money transfer app development companies tap into DevOps practices. It means continuous software integration and delivery when engineers start from small tasks and gradually scale. It also means comprehensive automation, including code development, regress and load testing, database updates, and middleware configuration.

In terms of technologies, mobile payment app development absorbs all the latest innovations and trends. Low-code development, artificial intelligence, blockchain, cloud, and big data analytics are some of the most prominent industry choices.

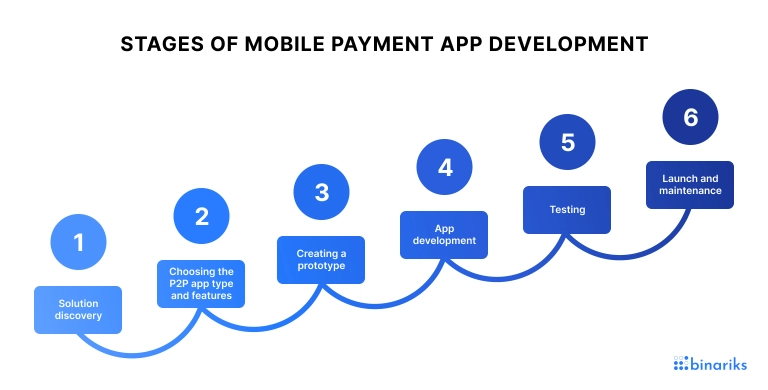

Stages of mobile payment app development

Now, let's talk about the mobile payment app development process. It's a step-by-step procedure that starts from a raw idea and continues with the following stages:

Solution discovery

Without requirements and market analysis, a startup will likely go in the wrong direction. Therefore, you need to engage business analysts before beginning to develop a payment app. They will analyze and match your business needs with market silos to recommend a potentially successful solution. At this point, you will also estimate the budget and create a mobile app development roadmap .

Choosing the P2P app type and features

At this stage, you will use the acquired information about expectations of the target audience to select the required functionality. At this stage, you will decide whether to build a native or cross-platform app.

Besides, consider safety issues and plan ways to protect users' data from attacks and leakage. It is crucial to build security into the P2P payment app from the very beginning.

Creating a prototype

Now, it's time for your UX/UI designers to show their mastery. They create a prototype of the future P2P payment app at this stage. The prototype materializes your ideas into a POC of an app communicating the navigation flow, design, and layout. You will also use the prototype to run a presentation for investors and start a marketing campaign. Mind mapping, identifying pain points, and most of the UI/UX design are done at this stage.

Money transfer app development

This stage is all about coding. Your software engineers, designers, business analysts, and other team members cooperate in developing the app. It usually takes the most time out of other mobile payment app development steps. The stage involves developing back-end infrastructure, APIs, server-side components, the front-end of the app, all additional features, and integration with all third parties.

Testing

QA engineers check the app functionality to detect bugs, vulnerabilities, and areas for improvement through the execution of test cases and scenarios.Code testing lets you polish the solution before the launch, making it more secure. What’s more, it considerably descreases the cost of bug fixing since the issues are found before they go into production.

Launch and maintenance

This is the final moment when everything is ready for launch. Your team publishes the application on platforms like Google Play or App Store. It also keeps working on the app behind the scenes to fix any issues (which always pop up after the first launch) and implement updates. At this stage, you set up support & maintenance and identify your future process with app upgrades.

Reasons to invest in P2P payment app development

Now that you know how to build a P2P payment app, you may have another logical question: Why should I? The answer depends on who you are.

Large financial institutions invest in online payment transfer app development to launch digital transformation . For banks, it's a chance to go from offline services to more digital customer experiences. They also save human resources by replacing branch workers with self-service P2P portals. Besides, some financial organizations create P2P payment apps as alternative products. In this case, mobile payment app development becomes a way to reach a new target audience and generate more revenue.

Startups and SMEs, on the other hand, view mobile payment application development as an attractive business niche. In 2021, 42% of US consumers made peer-to-peer payments via a direct money transfer service, according to data . By 2030, the global P2P payment market will reach $9,097.06 billion with a 17.3% CARG. It means anyone joining this market segment ends up in a rapidly growing field with crazy demand. It inspires startups to try their luck with new P2P payment solutions.

Re-engineer banking solutions and build new systems with Binariks

P2P payment app examples

During P2P payment apps development, you will probably borrow a lot from popular solutions because everyone should learn from the best. Below are the most downloaded and renowned P2P money transfer apps worldwide.

1. PayPal

PayPal is the most famous P2P payments app, with 56.6 million downloads, a source suggests. Being among the pioneers is one of the reasons behind PayPal's success. But there is more to it.

The PayPal app is a very convenient all-in-one solution. It allows users to securely keep their bank accounts, credit, and loyalty cards in personal digital wallets. With PayPal, they can also buy, sell, and hold cryptocurrency. It automatically transfers paychecks and government payments up to 2 days early.

Key features:

- You can send and request a money transfer by another user's name, email, or phone

- Apart from peer-to-peer payments, it allows you to buy/sell online

- Up to a $60,000 transfer limit, which is pretty high

- The PayPal Savings feature with 0.40% APY (6x the national average)

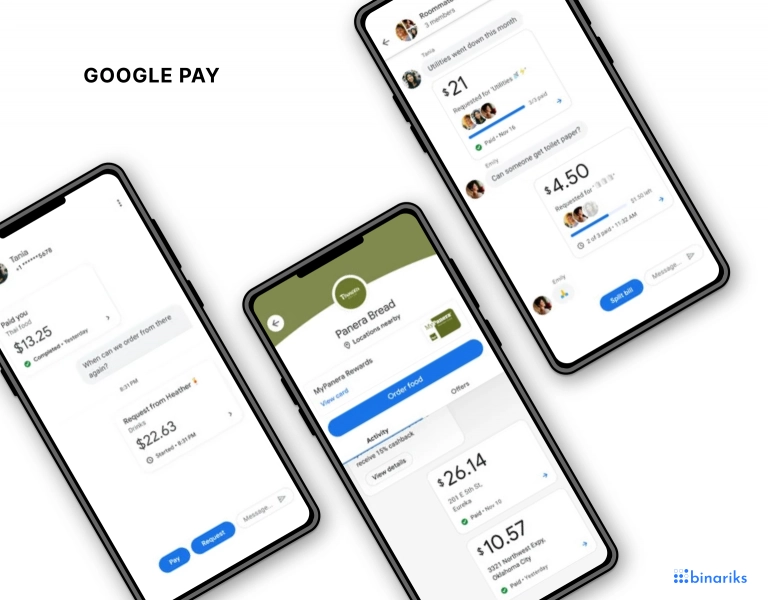

2. Google Pay

Google Pay is the second most popular digital wallet platform. It is supported on both iOS and Android devices. The app allows transferring money to individual users, groups, and businesses.

Users can do pretty much anything with this app, from splitting bills for meals to business transactions. Since it makes the payment directly to a recipient's bank account, they don't even need to install Google Pay to receive money.

Key features:

- Money transfers go directly to the sender and recipient's bank accounts

- Can be used at the checkout at retail stores

- Support on Android and iOS devices

- The Google Pay balance feature for receiving money to the Google account

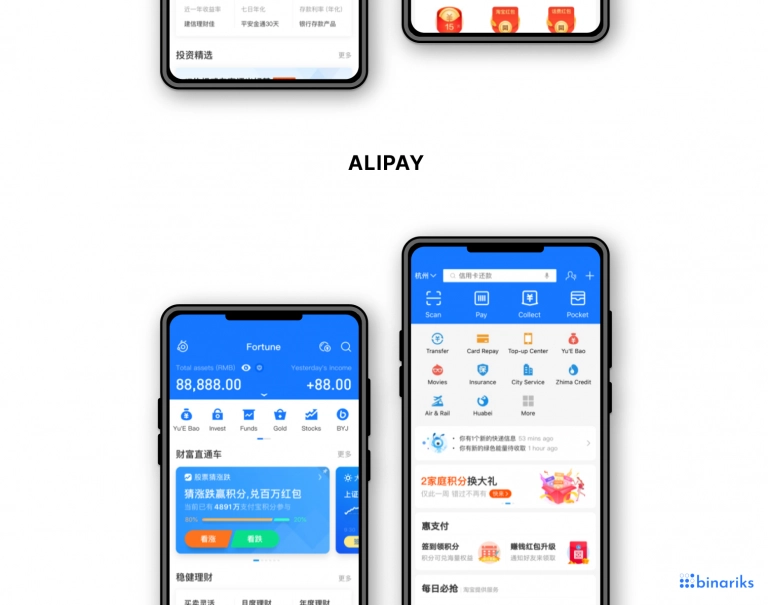

3. AliPay

AliPay is a Chinese solution by the Alibaba Group. It enables users to send peer-to-peer mobile payments, exchange currency, and do many other routines, like order food or pick an insurance scheme. That's why AliPay is slightly more than a P2P payment app.

Key features:

- Online and in-store payments

- Taobao and TMall order placement and tracking

- Additional features (e.g., taxi ride or food ordering features )

- Air/Rail/Movie ticket booking

- Discounts and promotions from merchants

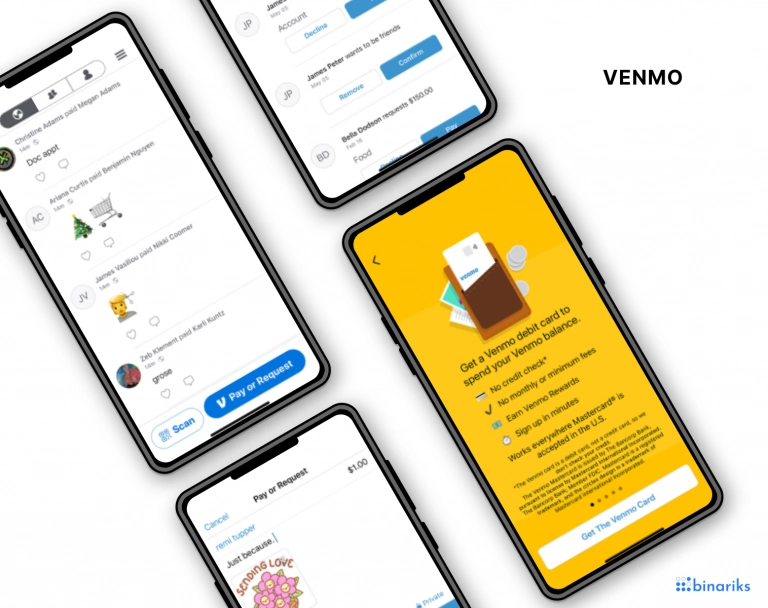

4. Venmo

Venmo is a P2P payment app with social media add-on. Users can send money with messages or emojis to make interactions with their peers more fun.

Venmo also allows buying cryptocurrency, creating a business profile, and paying in some of your favorite apps like Uber Eats, Grubhub, StockX, and Zola.

Key features:

- Payments to friends or users in close nearby

- Instant premium payments or free payments that take 1-3 business days

- QR support for touch-free payments at stores

- You can buy crypto for as little as $1

5. Zelle

Zelle results from cooperation between top US banks and credit unions' P2P payment app development. Like other apps listed here, it offers a simple way to send funds to friends and family. Transfers are swift and go directly from a bank account to a bank account.

If you use the services of a bank or credit union that supports Zelle, your online banking app will already have it. If not, you can download the app to send money to enrolled Zelle users.

Key features:

- Supported by leading US banks and credit unions

- No limits on receiving money

- Easy bill splitting for shared payments

- It takes minutes to send money to other Zelle users

6. Cash App

Cash App by Square is a P2P solution that, apart from standard payments, also allows users to invest in Bitcoin and the stock market. Even $1 is enough to start buying stocks. This app has a passcode, FaceID, and TouchID authentication to securely store confidential data.

Key features:

- You can buy and sell Bitcoin 100% free state and federal tax filing

- Comes with a free debit card you can use for transactions

- Investments in the stock market

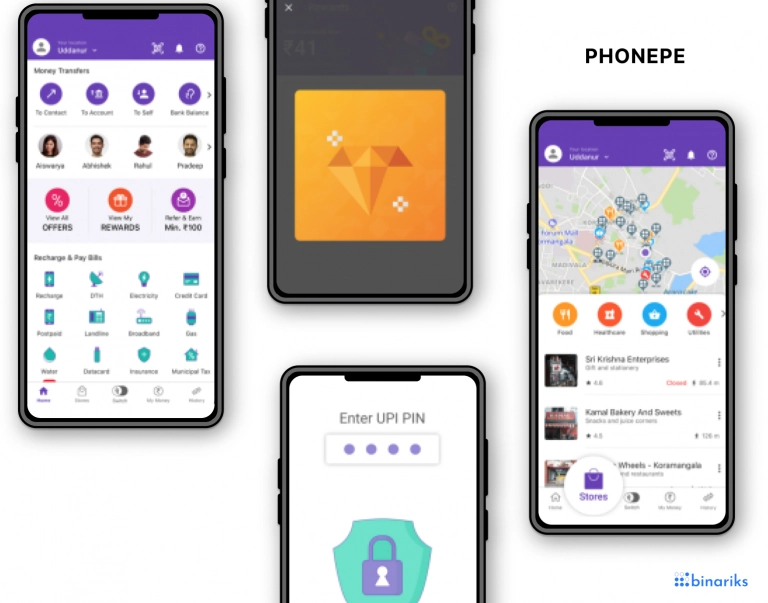

7. PhonePe

PhonePe is an Indian service with the usual P2P payment functionality and some specials. You can connect it with BHIM UPI, credit card, debit card, or wallet.

PhonePe enables users to recharge a mobile phone number, pay bills, buy insurance, make online and offline payments, save taxes, and more.

Key features:

- Online payments to peers and businesses

- Opportunity to purchase or renew insurance policies

- BHIM UPI money transfers

- Allow paying credit card, landline, electricity, and other bills

- Refund management

Payment app development cost

As a rule, to estimate the cost of mobile payment apps development, you should know what features the solution will have. The price starts at $20,000 and may even exceed $140,000. Money transfer app development is a lengthy process that requires many skills and expertise. Therefore, it's usually expensive.

Depending on the type of the team, the price will vary:

- In-house team: $140,000 - $200,000

- US local team: up to $300,000

- Freelancers: cheapest option, between $20,000 and $60,000, but inconsistency risks exist.

- Outsourcing team (Eastern Europe): $50,000 - $100,000

Consider hiring a remote team to cut costs and find skilled software engineers faster. Developers outside the US and Europe charge less while having the same level of expertise. It will also save you from the high recruiting expenses caused by the shortage in the local labor market.

Pick app development team

A fully stacked mobile payment application development team should consist of experienced professionals who are well-versed in an array of technologies and tasks, including AI, blockchain, and many others.

Payment app development team members

While not all teams are the same, and there is room for variation, some of the most common roles are:

- Project manager: Oversees projects, sets goals, and ensures meeting the objectives.

- Business analyst: A person overseeing business requirements, analyzing the market, and building a list of expected app functionalities accordingly.

- UI/UX designer: Designs the application's user interface and user experience.

- Developers ( mobile app and back-end): These professionals are in charge of building the application. The range of their expertise should include various languages and technologies, including blockchain technology, encryption, API, and e-wallet.

- QA engineers: They test the application throughout all stages of the mobile app development, report bugs, and ensure that the application is up to standard.

- DevOps engineer: In charge of practices like maintenance processes using automation tools, continuous integration, and continuous deployment.

- Legal and compliance expert: Ensures that the application is up to data with all regulatory standards in the industry.

Our experience

Binariks has a vast experience in online payment app development that helped us achieve confidence. Our engineers and project managers are well-versed in avoiding all bottlenecks of working on mobile payment apps, ensuring security and scalability.

Our expertise includes payment gateways, online payment systems, POS software, E-wallet mobile application, and recurring billing solutions. Whichever app you choose to develop, we most likely already worked on it. And if this is not the case, we have enough comparable expertise to develop a payment app that is relatively new to us and make it flawless. We assemble a dedicated development team based on your specific needs. Contact us to create a mobile payment app that will strive in a competitive market.

Final thoughts

Final thoughts

P2P online payment app development is a niche that attracts many large market players and startups. Its steady growth and the increasing number of mobile payment users promise a bright future for those who succeed. Businesses that attract users with their P2P apps enjoy high revenue and fame.

At the same time, it takes a lot of work to become the next PayPal. You will need to carefully create the app concept and invest a lot in money transfer app development. Assembling a skilled tech team is another challenge.

Binariks can help you with the latter. We have years of experience as a technology partner for fintech startups, SMEs, and enterprises across the globe. Binariks can offer you a dedicated team or allocate the necessary specialists to join your project at any stage.

Check out our portfolio here and contact us to discuss your P2P payment app development idea.

FAQ

Share